Do you know what is the advantage of chip credit card? If you came here to find out just that, please read below. In this post we will outline what are chip credit cards, what is the advantage of using them and much more.

Paying for something has never been easier since the advent of credit cards in the 1960s. It is easier, accessible, and more convenient to pay through them. But, as technology advances, the need for secure and protected banking practices against fraud and cyberattacks is becoming necessary.

Cybercrime is rising. Over the past few years, there have been large-scale hacking incidents aimed at online and offline retailers due to their lack of secure technology.

In 2013, Target, the 8th largest retail corporation in the United States, experienced a massive data breach that compromised over 40 million customer payment card accounts and exposed over 65 million people’s personal information.

The personal information breach included phone numbers, email addresses, credit, debit card numbers, and even credit card verification codes.

This compromised data could have been used in a wide range of harmful activities such as credit card fraud and identity fraud. Security experts believed that a cyber attacker installed malware on the retailer’s checkout machine, which stole credit card data every time a customer swiped their card.

Thus, to tighten security measures and introduce fool-proof system against such breaches, major customer payment card account companies in the U.S, such as MasterCard and Visa, adopted chip cards.

It’s a proven technology that offered better protection against fraudulent transactions and personal information safety instead of magnetic cards.

Quick Navigation

What is the Advantage of a Chip Credit Card?

What Are Chip Credit Cards?

Chip credit cards have a microprocessor – a computer embedded on your card-chip approximately 1 centimeter in width that authenticates each credit card transaction.

You may have seen the golden square on the front of your credit card and disregarded it, but that tiny golden microprocessor chip is the reason this new plastic card is called a Chip Card. This golden square contains your personal information, including your 16-digit card number, security code, and card expiration date.

What are some other names for Chip-Credit Cards?

- Smart Chip Cards.

- Smart Payment Cards.

- Chip and PIN cards

- Chip Cards

- Smart Cards

- EMV smart Cards

- Chip and Signature cards.

How do Chip Credit Cards Work?

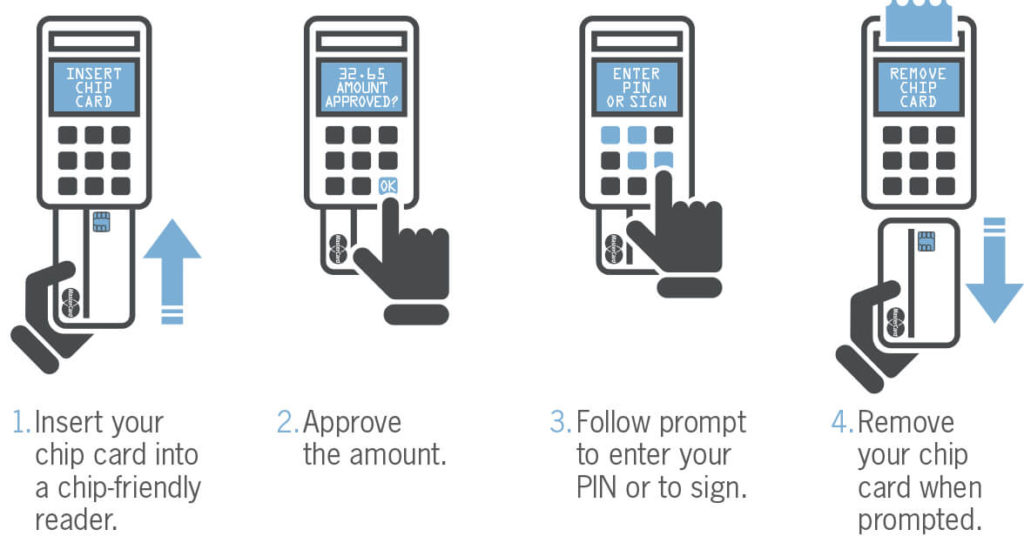

When you use a credit card to make a purchase, the terminal needs to verify that you’re actually using the card and not someone else. To make a chip credit card work, you have to insert it into an EMV-enabled device or panel and enter your PIN. This two-part verification process limits fraudulent transactions.

Every time you conduct a transaction on a chip credit card, it generates a one-time code that your credit card company uses to ensure that the actual card was provided and not a copy of it.

The chip on the card and the terminal work together to make an encrypted code unique to the transaction taking place and can only be used once.

It is always different for every transaction, and if anybody copied that code, they wouldn’t be able to use it to make purchases.

This code or number is created by combining information in the chip with the information in the terminal. It is done using instructions contained in the chip, and the code is encrypted by the microprocessor using a unique password stored in the chip.

The card issuing company, or sometimes the terminal itself, can then decrypt the code and verify the card user by comparing the information they have with the information they received.

This process adds several security layers to your data and makes it hard for your information to be used in fraudulent transactions.

However, it is necessary to note that just having a chip card does not ensure security. Rather the capability of the terminal (ATM, POS) which you use and your bank’s policy play a large role in making your transactions and personal information secure.

How Are Chip Cards Different from Magnetic-Stripe Cards?

A decade ago, almost all the credit card transactions in the U.S were done with a magnetic-stripe card. Magnetic-stripe cards contain a magnetic strip affixed to the back of the plastic card.

The magnetic stripe’s purpose is to store data such as your 16-digit card number, card expiration date, and your 3-digit security code. The magnetic stripe is used to transfer data to the terminal where the card is used.

Magnetic card technology is relatively simple compared to today’s technology. You swipe the card in the terminal; it sends an authorization request that includes your data to your card’s bank and the issuing bank (MasterCard, Visa). In response, your bank sends an authorization back to the terminal. If everything is approved, the transaction is completed.

The problem here is that if someone steals the credit card information during a transaction, they can potentially get all your personal and credit card information because it isn’t even protected.

They can replicate the magnetic strip inexpensively with low-tech equipment. Once stolen, the data can be used to make counterfeit cards, which can then be used to make a fraudulent purchase of merchandise.

Thus, the primary and most crucial difference between a magnetic stripe card and a chip card is the security they provide to the customer. Chip cards are better protected in comparison to magnetic cards.

Chip cards help prevent fraud in two ways:

- Making fraudulent transactions difficult

- Making card duplication difficult

What are the advantages of Chip Cards over Magnetic Strip cards?

Magnetic cards use static authentication, which opportunists can easily copy, and chip-embedded cards use different data and encryption for every transaction, making any information captured through the card terminal useless for fraudsters. This makes chip-credit cards safer and a better alternative to magnetic strip cards.

There are many advantages of chip cards over magnetic-strip cards. Chip cards reduce the likelihood of fraud, decrease the chances of information theft and counterfeiting of cards.

The advantages of Chip Cards are described below.

1. Chip Cards Offer Better Security Because They Use Smarter Technology

Since the 1960s, customers in the United States have been using magnetic strip cards. After a few cyberattacks on giant retailers such as eBay, Target, and various other companies, a realization smacked us in the face. We needed better security.

Chips card came to the rescue. Chips cards have a tiny low power microprocessor embedded in a chip on their plastic body.

When this chip comes into contact with a terminal, it shares information, verifies your PIN, and creates a unique code for each transaction.

This unique code is made using instructions and a unique password stored on the chip. The card provider can then decrypt this code to verify that it came from your card’s chip. When the code is confirmed, the purchase is approved.

Remember, the chip card produces a unique code for every single transaction that takes place. So, if someone gets ahold of the unique code, it is rendered useless due to its limited time of use.

Another vital thing to note is that fraudsters are unlikely to figure out the unique password that enables this encryption because it is only known to the microprocessor chip and the card issuer. This grants chip credit card users additional security.

Banks also monitor the chip card activity by location, the purchase amount, and the retailer charging the amount. If any suspicious activity is detected, the bank will attempt to contact the customer by calling, texting, or emailing them to verify if they used their card.

2. Chip Cards Lessen Card-Present Fraud Risks

After the Target breach in 2013, which exposed the personal information of over 65 million paying card customers, businesses, and customers became more cautious.

Experience had proven by that point that magnetic strips could be skimmed without much effort. Counterfeit cards could be made by using low-tech, inexpensive methods.

According to Nilson Report in 2015, the U.S accounted for 48 percent of the total payment card fraud losses worldwide. It led to losses of over $16 billion in 2014; 60 percent of them were due to card issues.

Due to the ‘static’ nature of the information stored on a magnetic strip card, when a magnetic-strip card is entered into a terminal, the information present in it is easily accessible by potential fraudsters. A magnetic stripe on a card contains data that sits on the card, always the same, without any protection.

By attaching a magnetic stripe reader over an existing card reader, criminals can capture data about every card that’s slipped into the reader.

In comparison, chip credit cards generate a unique encrypted code for every single transaction that takes place. This encrypted code is created in tandem by the terminal and the chip. They create it by using the instructions and the password present on the chip for one-time use.

So, if a fraudster gets ahold of one unique code, it would be useless to them as they wouldn’t have the ability to do anything with it. Furthermore, the password used to encrypt the code is only present on the microprocessor chip. This further reduces the chances of someone stealing the information.

The code is then decoded by either the terminal itself or the card issuer, verified, and only then is the transaction complete.

Moreover, it is vital to note that there are two kinds of basic credit card transactions: card-present and card-not-present transactions. Card present transactions are committed when you physically insert the card into a terminal, for example, ATM withdrawal.

Card-not-present transactions occur when a card is not present physically for the retailer to inspect, for example, online shopping. Thus, using chip cards only lessens the likelihood of fraud in card-present transactions, not card-not-present transactions.

Using chip credit cards with a complicated verification process, one-time code generation for every transaction and an unrecoverable password decreases the likelihood of fraud risks in card-present transactions. However, magnetic-strip cards have easily accessible static information, making them more prone to fraud and identity theft.

3. Chip Cards Are Used All Around the World

Chip cards were first designed in Europe in the 1990s and are most prevalent in Europe, with over 75 percent users in 2017.

Since then, most of the world has jumped on the bandwagon, and almost every bank across the globe offers chip cards because they provide better security and lessen the chances of identity theft and fraud. In 2018, Visa reported that chip-cards contributed to over 95 percent of card-present transactions.

In the United States, the transfer from magnetic strip cards to chip credit cards started in 2011 and will go on for several more. It is hard to tell when we will see cards in the United States without magnetic stripes on cards.

It was slow going at first because not all card-readers were chip-enabled; they still aren’t. But in 2017, Visa reported that over 62 percent of Visa credit and debit cards in the U.S were chip cards, a 182 percent increase since October 2015.

4. Chip Cards Technology Makes Counterfeiting Cards Very Difficult

Counterfeiting magnetic cards is not very difficult to do. A skimmer could copy card data by using a magnetic card strip and “burn” that data onto a counterfeit card. They could use it as the original until identity theft or card theft is reported by the actual owner.

In comparison, counterfeiting chip cards is a hard-to-commit endeavor because it requires expertise and the use of expensive, high-tech equipment.

The microprocessor chip also makes it harder to gain information about the customer because it creates a one-time code for every transaction. This code is rendered useless the transaction reaches completion.

The microprocessor also can’t be copied, scanned, or replicated. Fraudsters would have to drill into the chip with lasers and other expensive equipment to get the chip out, only to find that it is faulty because this kind of extraction only works some of the time.

The unique one-time code is produced in the chip with a password known only to the microprocessor chip and the card issuer. This password encrypts the one-time code created by the terminal and the chip. Since the password is relatively inaccessible, it is hard for fraudsters to get ahold of it.

However, magnetic strips are currently present on all issued credit cards because some retailers do not accept chip-cards. The presence of the magnetic strip can make the card vulnerable to skimming.

This means that if you use the magnetic stripe present on your card for a transaction, then you will have increased chances of your card being skimmed by thieves.

It is best to keep in mind that chip technology doesn’t offer complete protection against fraud. If you use a hacked chip-enabled terminal, fraudsters can get your card information, but it does make card-present fraud and counterfeiting cards more difficult.

In conclusion

We hope we were able to provide you with an answer to the question of what is the advantage of a chip credit card and you now know what it is, and why you should use one.

Chip credit cards are more secure than magnetic-strip cards because the microprocessor present in the credit card lessens the likelihood of fraudulent transactions.

It rules out the possibility of counterfeiting a card because of the hideously expensive tech setup needed to extract the chip from the card.

Chip cards are easy to use and make card-present transactions more secure. Although they aren’t the perfect fool-proof protection that we all want against fraudsters and hackers, they’re a huge step up from the easy-to-skim magnetic stripe cards.

In the end, remember that chip cards can only protect against card-present fraud; they don’t offer any protection for online fraud. So, be vigilant when paying online and keep an eye on your credit reports to check for suspicious activity.

More similar posts: