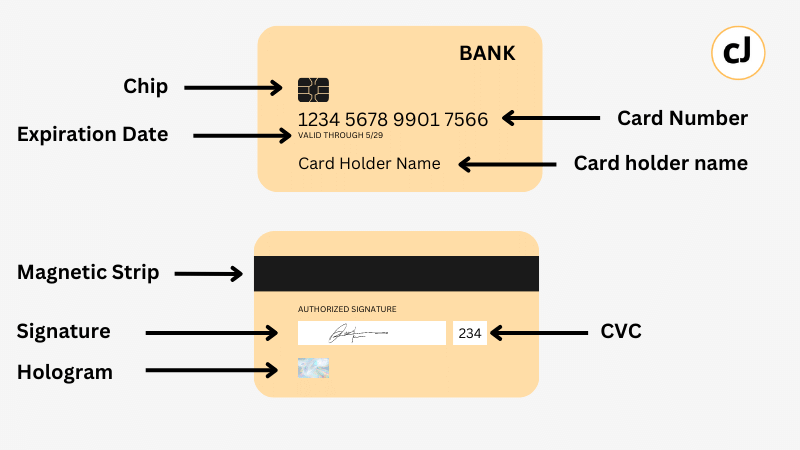

The CID, or Credit Identification Number is 3 or 4 digit number that is printed on the back side of the card next to the signature area. On Discover Cards, Master Cards and Diners Club cards the number is just following the card account number.

The CID was first introduced in the early 2,000 by the banking system as an extra and new layer of security with the growing usage of credit cards over the internet. In contrast to when you swipe your card in a physical shop, and at that point the account number and CID is transmitted to the bank to identify and confirm the card, when shopping online you obviously don’t swipe, so an extra layer of protection is needed.

When a user is asked to enter the CID every time he tries to purchase something online, it is another indication that the owner of the card is actually using it, and it reduces fraud by a good margin.

Where can I find the CID

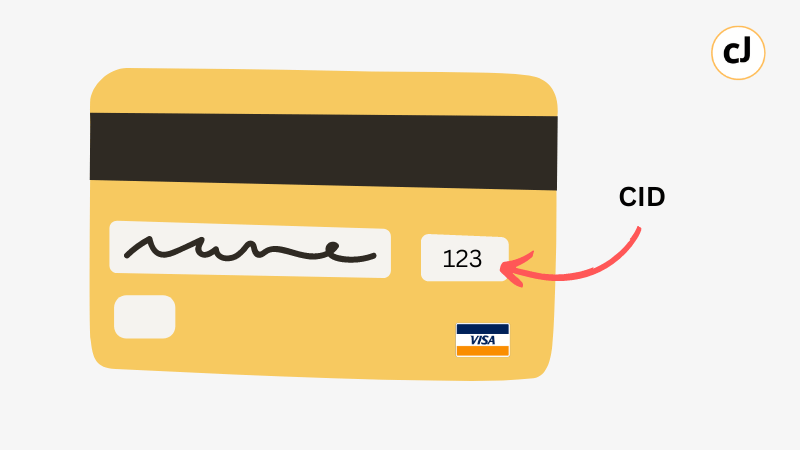

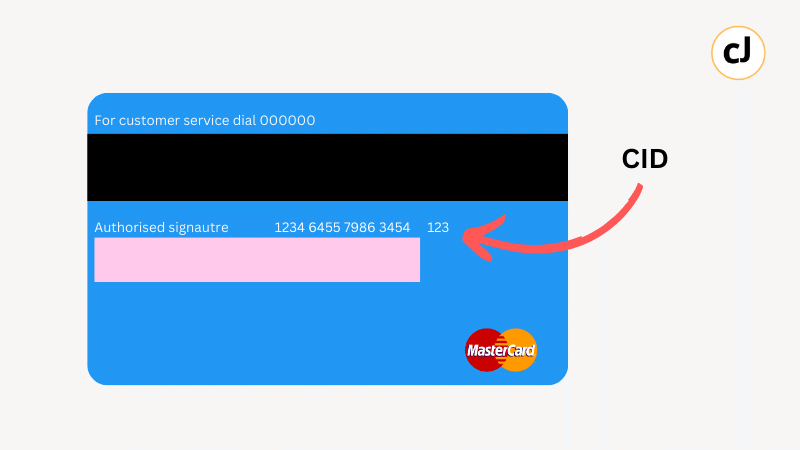

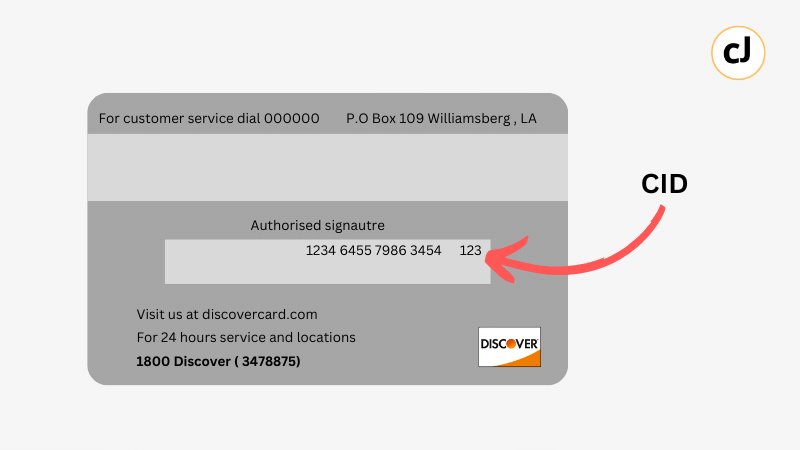

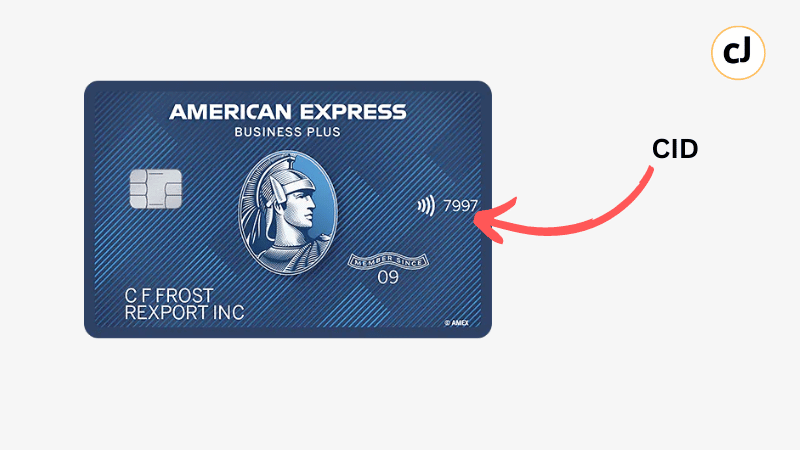

Here is where you can find your Identification number based on the card you have:

VISA – a three digit number that is printed on the back side next to the signature area

Master Card – a three digit number printed on the back side of the card just after the account number.

Discover Card – a three digit number that is printed on the back side next to the signature area

American Express Card – a four digit number that is printed on the front side of the card on the right side.

Here is a full look at a credit card structure in one easy to understand infographic

2 thoughts on “What is Credit Card ID Number. Credit Card Structure Explained”