In order to run a successful business, it’s important to understand your profit margins and how to calculate them. Gross margin percentage is one of the most important metrics for evaluating a company’s profitability. In this article, we will tell you how to calculate gross margin percentage in Excel. So, whether you are a business owner or an investor, this article is for you!

Quick Navigation

- Learn How To Calculate Gross Margin Percentage In Excel?

- What is Gross Margin?

- Why Is Gross Margin Important?

- How To Calculate Gross Margin Percentage?

- Calculate Total Revenue

- Calculate COGS or Cost of Goods Sold

- Put these values in the formula

- How To Calculate Gross Margin Percentage In Excel?

- Conclusion

- Frequently Asked Questions

Learn How To Calculate Gross Margin Percentage In Excel?

You must continuously monitor and evaluate your business processes to prosper if you’re running a business. There are many indicators to assess your business’s performance, which further gives suggestions on how to get better with each passing time.

Gross Margin is one such indicator that assesses your company’s potential to earn profits. This article will talk about Gross Margin, its importance, and its calculation – both manual and through MS Excel.

What is Gross Margin?

Gross Margin, also known as Gross Profit Margin, is the percentage difference between revenue and costs of goods sold (COGS) divided by revenue. It is, thus, the amount of leftover revenue, which is left after payment of costs of goods sold (COGS).

Note that there is a distinction between ‘Gross Margin’ and ‘Gross Profit’. The former is expressed in percentage or ratio, while the latter is expressed in absolute numbers.

The mathematical formula for the calculation of Gross Margin is as follows:

Gross Margin (%) = [Total Revenue – COGS]/ Total Revenue x 100

Where

COGS stands for Costs of Goods Sold.

Why Is Gross Margin Important?

In layman’s terms, gross margin estimates the efficiency of your company in making sales and providing services.

It is one of the key performance indicators like Sale Revenue, Net Profit, Monthly Recurring Revenue, and Customer Acquisition Costs.

Many companies also consider the gross margin as the primary indicator of performance. Besides, it helps you in assessing their understanding and performance. You can improve your company’s performance by having an estimate of its gross margin, which aids in:

- Developing a competitive pricing strategy

- Managing inventories

- Identifying events and opportunities to minimize the costs, etc.

How To Calculate Gross Margin Percentage?

To calculate the value of Gross Margin, you need to find the values of variables that are mentioned in its mathematical formula, concerning your company; and then fill them in the formula to get the answer. Thus, you need to find the value of total revenue and costs of goods sold (COGS), which can be found on the income statement.

In this way, the process of calculating gross margin can be delineated into three simple steps, which are as follows:

- Calculate total revenue

- Calculate COGS

- Put these values in the formula

Calculate Total Revenue

You can find the total revenue for the desired period by multiplying the total quantity of goods sold during that time by the price for which they were sold. For instance, if you sold 50 items for $30 each, your total revenue becomes 50 x $30 = $1500.

Hence, TR = P(Q);

Where TR = Total Revenue

P = Price of each item

Q = No. of items sold

Calculate COGS or Cost of Goods Sold

COGS, also known as cost of goods sold refers to the cost of items you sold. This includes the costs of labor and raw material only. The indirect costs of utilities, marketing, taxes, etc. are omitted. To calculate COGS, the value of inventory at the end of the period is subtracted from the sum of any purchases and the value of inventory at the beginning.

Hence, COGS = Purchases + Value of Inventory at the beginning – Value of Inventory at the end

Put these values in the formula

After determining the values of various variables, put their values in the formula given below:

Gross Margin (%) = [Total Revenue – COGS]/ Total Revenue x 100

The value of Gross Margin in percentage refers to the amount of each dollar that you get in your pocket, after incurring costs over its production. For instance, if the value of Gross Margin for your company turns out to be 15%, then it means that you get a profit of 0.15 cents for every dollar.

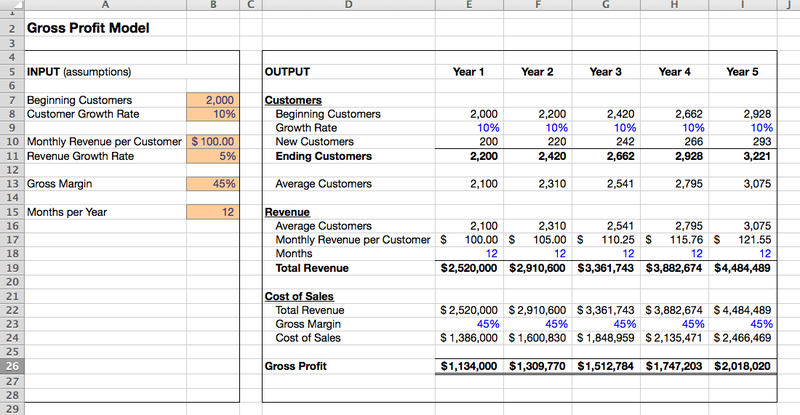

How To Calculate Gross Margin Percentage In Excel?

MS-Excel from the Office Suites is an essential tool for making various calculations. It can also be utilized for calculating the Gross Margin Percentage for your company. The following steps will tell you How To Calculate the Gross Margin Percentage In Excel?

- Open MS Excel from the MS Office Suite on your system.

- Enter the value of total revenue in cell A1. Alternatively, if you prefer calculating individual profit margins, enter the value of your product’s retail price in the same cell.

- Next, input the value of the total cost of sold goods in cell B1. If you wish to calculate individual profits, enter its wholesale cost.

- In cell C1, type the formula = (A1-B1)/A1 to calculate the gross margin percentage.

- To get the value in percentage, right-click cell C1 and select the option ‘Format Cells’. Choose the Percentage option. This will change the decimal format to the percentage format.

Conclusion

A useful indicator of the performance of your business in earning profits, gross margin percentage can be calculated manually by putting values in its mathematical formula.

Besides, in the digital age, where MS Excel is all-pervasive and is used in nearly all the fields, it can also be used for calculating the Gross Margin by following a required series of steps.

Frequently Asked Questions

Q1: What is the difference between gross margin and net margin?

A: Net margin comprises deduction of all expenditures including indirect ones like administrative costs, etc., which are excluded in the calculation of gross margin. Its value is, thus always less than the value of gross margin.

Q2: What factors affect gross margin?

A: The value of gross margin depends on the value of variables that form its mathematical formula, i.e. COGS and Total Revenue.

Q3: What is an ideal gross margin for a company?

A: The companies usually consider a 10-20% gross margin as high and ideal. However, the ideal gross margin varies from industry to industry. For instance, industries offering accounting services consider 15% as ideal, while those with grocery retail consider 10% as the ideal gross margin.