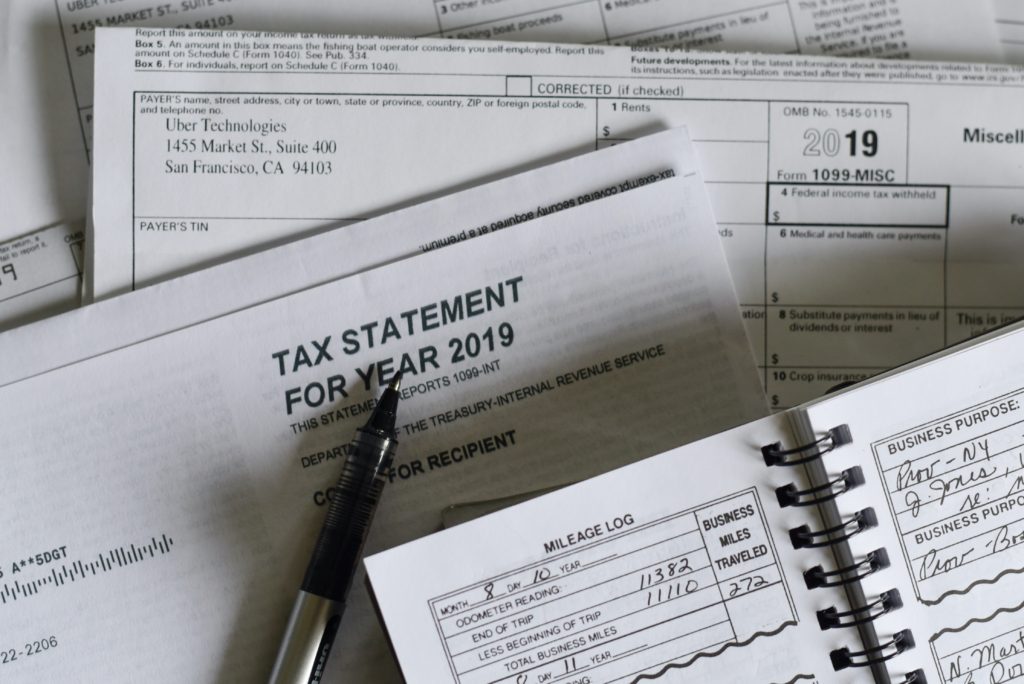

You must have heard the infamous statement, “Your Federal tax is due now.” As April 15 approaches, we can feel anxiety and stress around us. Everyone is busy completing and evaluating their account statements, meeting with their accountants, double-checking tax calculations, and whatnot.

This is because millions of people owe money to the IRS (Internal Revenue Service), which is to be paid on time. And considering how persistent the IRS is when it comes to getting their money, the hustle seems reasonable.

Want to know more about ‘Federal Tax Due?’ We will help you understand the term better and how you can be in the good books of the IRS for at least a year.

Quick Navigation

What Is Federal Tax Due?

In simple and precise terms, Federal Tax Due refers to the money you owe the IRS. If you use software like TurboTax to file your taxes, then you must have seen the term appearing on top of the screen. As you complete your taxes, the tax due amount is replaced by a tax refund.

People who still file their taxes manually using paper to calculate the amount will see the term ‘Amount You Owe’ in the tax form rather than ‘Federal Tax Due.’ Either way, the amount mentioned near the phrase is what you have to pay the IRS.

The more allowances you claim, the less the taxes IRS will withhold from your paycheck. The less the tax withheld annually, the more the chances of you paying tax on time. To sum it up, under-withholding means you will owe to IRS, and over-withholding means you will get a refund at tax time.

3 Tips to Remember While Paying Federal Tax Due

We all know tax payments can be a real hassle. You have a lot on your plate, and there is no scope for a mistake. To make the process stress-free and straightforward, we have a few tips:

Prefer Direct Pay- When you choose the Direct Pay option, the IRS payment is deducted directly from your bank account. This is the easiest and fastest method to pay taxes and avoid the additional fees associated with IRS payments.

Pay on Time- As simple as it sounds, most people fail at it, and that too every year. Ensure that you pay the amount before the IRS tax deadline to avoid penalties and interest rates.

Ask for Installment Agreement- If you can’t pay the full amount in one go due to lack of funds, request for an installment agreement by filing Form 9465.

How to Pay Federal Taxes Due?

Based on your convenience, you can pay federal taxes in a number of ways:

- File taxes electronically to pay via checking account. This is called the Direct Pay method.

- You can pay taxes through mail as the IRS accepts checks and money orders. However, it doesn’t accept money orders or single checks for the amount over $100 million.

- Paying taxes through credit or debit card is another option. To ensure that the IRS gets your tax payments faster, use a direct bank wire. However, for this method, you need to pay banking fees.

- The IRS also lets you pay cash at any retail partner location. It accepts cash up to $1000, but a fee of around $3.99 is applied per payment.

Can You File for an Extension?

Yes, you can request an extension but have to file a complete tax return until October 17, 2022. Also, you must know that this doesn’t mean pushing the deadline for IRS tax payment.

You need to pay the estimated amount you owe to avoid tax penalties. An extension only gives you enough time to complete your tax return.

What Happens If You Miss the Deadline?

Quite an obvious question, isn’t it? Well, individuals who are owed a refund don’t have to pay the penalty or fine for filing federal tax late. However, this may vary in the case of state taxes, so it is best to postmark or e-file taxes on time.

On the other hand, penalties and interest accumulate on the unpaid taxes after the deadline if you owe the IRS. The penalty amount is 5% of the tax due for every month you miss the return, with the fees hiking up to 25% of the due amount after 60 days.

There is also a late-payment penalty of 0.5% of the tax due for each month you delay the return, and the penalty may go up to 25% of the unpaid tax, based on how long you take to file.

For citizens serving in the military, combat zone, or a contingency operation in support of the armed forces, IRS grants you additional time to file.

Is It Good to File Early?

Not many individuals care to file their taxes days before the deadline. However, we would suggest that if all your paperwork is in order and you are owed a refund, then file as soon as possible. According to Joe Burhmann, a senior financial planning consultant, “From a planning perspective, the IRS likes that.”

But if you owe money to the IRS, then there is no harm waiting for a bit longer. This will give you enough time to know the best way to pay the money. You can figure out better whether to use a credit card, ask for a loan, or something else.

Make sure to prepare your taxes on time, even if you are not filing early. Get your 1099 and understand what you are dealing with because seeking knowledge about the IRS and federal taxes can take you a long way.

Final Thoughts

We hope that this article helped you get better insights into ‘Federal Tax Due’ and questions associated with it. Understanding the phrase means that you pay the correct amount to the IRS without any delay, thus avoiding penalties or interests.

This way, you not only keep Uncle Sam happy but also make sure that the government has enough funds it needs to serve the public. Gain control of your tax plan but remember not to stress out.