Every year in January, employers file the Form W2 to report an employee’s income from the last year, the amount of tax the employer withheld, and other information.

Anyone who works is legally bound to pay taxes. For many, filing taxes is a nightmare.

Tens of forms to be filled. Hundreds of things to write and keep track of. However, taxes aren’t something you can run from, and neither should you.

It doesn’t matter if you’re doing your tax returns yourself or are having them prepared professionally; you should know what tax forms tell you and how they affect your income.

KEY TAKEAWAYS

- W2 Form is how you report your annual income to the IRS. Both Wage and tax statement of employees.

- Employers who pay their employees at least $600 in cash or non-cash payments for the annual year, including any tax benefits, use this form.

- You should get a Form W2 from your employer after the end of a taxable year.

Quick Navigation

- What Is A W2 Form?

- What Is Form W2 Used for?

- When Should You Get A W2 Form?

- How Many W2 Forms Do I Need?

- What Is the Minimum Amount to File A W2?

- What to Do If You Don’t Receive It?

- How Do You File Taxes If You Don’t Have A Form W2?

- What If You Finally Receive Form W2 After a Long Delay?

- A Closer Look: How to Read at the W2 Form

- What Should You Do If You Get Two W2 Forms from The Same Employer?

- Can You File Two W2 Forms Separately?

- What Happens If I Don’t File A Form W2?

- Conclusion

What Is A W2 Form?

Form W2 is an annual wage and tax statement form sent to employees and the employers’ Internal Revenue Service (IRS).

It is also one of those tax forms that you don’t have to fill. Your employer fills in all of the information on the form. It reports an employee’s annual income and federal, state, and other taxes tax withheld from it.

It is a significant form, and the IRS requires the employer to send it to the employee no later than 31 January.

In short, W2 forms show the income an employee earned in a year minus the taxes takes from it.

What Is Form W2 Used for?

Employers who pay their employees at least $600 in cash or non-cash payments for the annual year, including any tax benefits, use this form.

The form is used to show an employee’s annual income and the taxes taken from their income.

Employers complete the W2 forms and send the completed form to employees who file them in their tax returns.

W2 forms are only used for employees who work for companies, not for self-employed or independent contractors. They need form 1099 instead.

If an employee has made at least $600 in the annual year, they have to receive a W2 form no matter what.

When Should You Get A W2 Form?

You should get a Form W2 from your employer after the end of a taxable year.

You should receive it before 31 January or early to mid-February. It should list how much money you made in the previous year, the amount withheld in taxes, and how much of your pay went to federal and state taxes.

How Many W2 Forms Do I Need?

An Employer needs six copies of every W2 form:

- Two of these copies are sent to the government

- The employer keeps one

- Three go to the employee to file the copies with their tax returns.

In further detail, copy A – printed in red – is sent to the Social Security Administration (SSA) along with form W3, which reports the total amount of forms W2 sent by the employer.

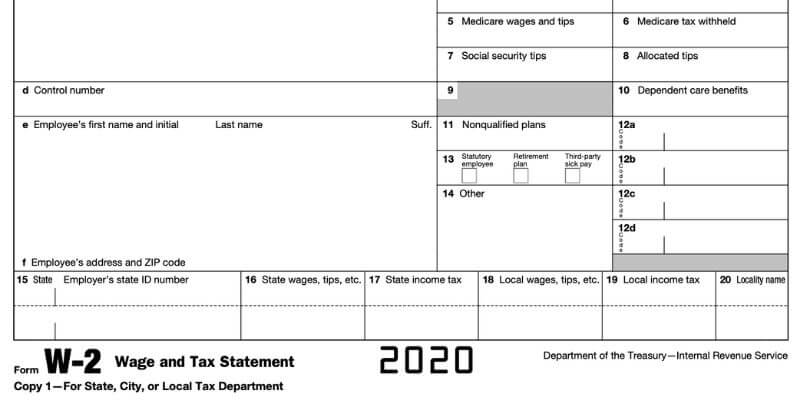

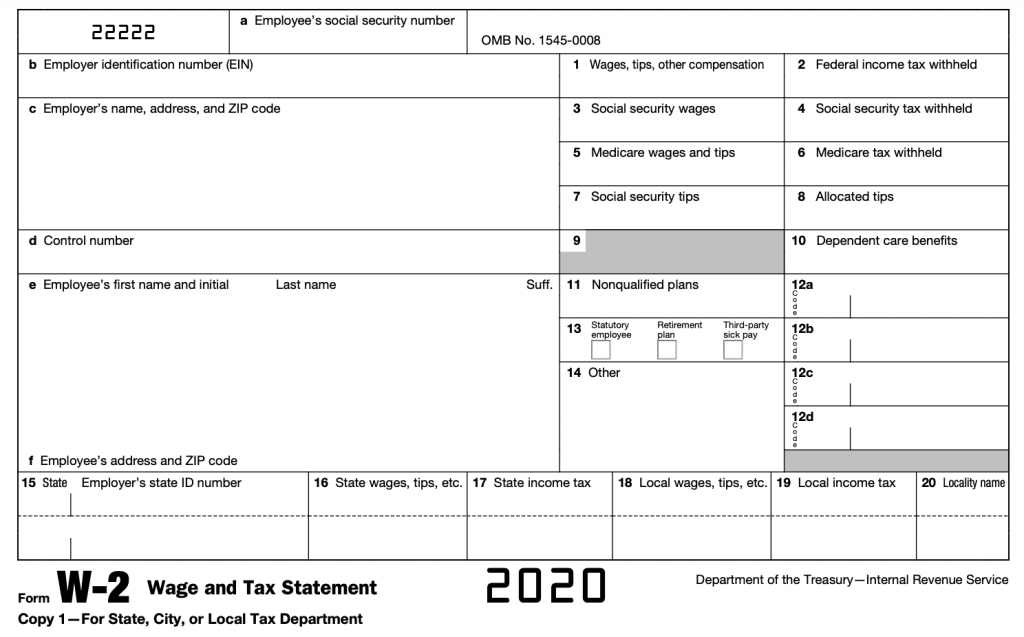

Copy 1 – printed in black – is sent to the appropriate local, city, or state tax department.

Employers retain copy C.

Three copies are sent to employees:

| Copy B | copy 2 | copy C |

| which is used to report federal incomes taxes and is filed with income tax return; | which is used to report the local, city, or state income tax; | is for the employee’s records and should be kept for around three years after filing. |

What Is the Minimum Amount to File A W2?

Form W2 is used by employers who have paid at least $600 to an employee in a tax year.

No payment threshold is required to file a W2 form. Hence, there is no minimum amount of income you need to file a W2 form.

Someone who earns $20,000 per year will file it the same as someone who earns over $100,000.

What to Do If You Don’t Receive It?

If you haven’t received your Form W2, contact your employer or HR department, and ask if the Form W2 was mailed.

The mail could have been returned to the employer because of an incorrect or incomplete address or probably because it couldn’t be delivered.

After correcting the issue, you can ask your employer to resend the document.

But, if you don’t receive your W2 form by mid-February or the end of February, and you have exhausted your contacts, and have called your employer, then you should call the IRS at (800) 829-1040 or visit the IRS Taxpayer Assistance Center.

The IRS will need your:

- Name, address, phone number, and social security number.

- Employer’s name, address, and phone number.

- An estimate of your wages and the federal income tax withheld the previous year.

Using this information, the IRS will contact your employer and request the W2 form.

They will also inform the employer of the repercussions of failing to meet the 31 January deadline.

The IRS will also send Form 4852, a form that can be used in place of Form W2 if the employee didn’t receive their form or if their form was incorrect.

Form 4852 grants an automatic six-month reprieve to the filer so they can wait for their Form W2.

How Do You File Taxes If You Don’t Have A Form W2?

If you still don’t receive Form W2 by mid-April, then you should use form 4852 to file your returns as accurately as possible.

However, you should be aware that filing Form 4852 will slow down the processing of your returns, and if your tax estimate is less than what you owe, then penalties and interests may apply to your income. So, be careful.

What If You Finally Receive Form W2 After a Long Delay?

Suppose you finally receive your Form W2 after you have filed your tax returns using Form 4852.

You find that the information presented on the Form W2 is dissimilar to the information you presented on Form 4852.

In that case, you should use Form 1040X, Amended US Individual Income Tax Return.

A Closer Look: How to Read at the W2 Form

1. The left side of the form deals with identifying information.

Box a. This box is used to enter your Social Security number. Recheck this because if this is incorrect, it can cause delays in your tax return.

Box b. Your Employer’s EIN (Employer Identification Number) is reported in box b. An EIN is a nine-digit number that the IRS assigns to your employer. It is used to identify the tax accounts of employers.

Box c. Reports your employer’s name, address, and ZIP code. This is either the address or the legal residence of your employer. It could also be the place you work. The address could vary if the employer has several offices.

Box d. This box reports the control number used by your employer’s payroll department. Since it isn’t used a lot of time, box d may be left blank.

Box e and f. These boxes are joined together on the W-2 form. Box e reports the employee’s legal first and last names as stated on their Social Security card, and Box f reports the employee’s address and ZIP code. If this information is incorrect, it could cause delays in processing tax returns.

2. The right side of the form deals with numbered boxes that record your financial information.

Box 1: Reports the employee’s total taxable salary, including any tips, bonuses, and other taxable compensation minus 401(k), pre-tax benefits, and payroll deductions.

Box 2: Shows the total federal income tax withheld from the employee’s pay during the year.

Box 3: Shows the total amount of an employee’s wages that fall under Social Security tax.

Box 4: Reports the total amount of Social Security taxes withheld from your salary for a year. Social Security tax is calculated at a flat rate of 6.2%. You cannot have more Social Security withholding than the maximum wage base multiplied by 6.2%.

Box 5: Shows the total amount of wages and tips that were taxed for Medicaid. There is no minimum wage base for Medicaid. Medicare taxes include most taxable benefits.

Box 6: This box shows all your salary and tips that were withheld in taxes for Medicaid. As of the 2020 tax year, Medicare tax is flat 1.45%. If you earn more than $200,000; then, you may need to pay .9% additional Medicare tax.

Box 7: Reports any tips you told your employer about. This box would remain empty if you didn’t report any tips.

Box 8: This box shows any tips that your employer has allotted to you. It can be considered as income, but it isn’t included in the total taxable salary in box 1.

Box 10: Reports the amount of dependent care benefits your employer paid to you or the total amount deducted from your wages for the dependent care assistance program. Anything over $5000 will be reported in boxes 1, 3, and 5. Anything less than $5000 will be considered non-taxable.

Box 11: shows the amounts given to you from your employer’s non-qualified deferred compensation plan.

Box 12: This box reports different types of benefits and compensation indicated by either a single or double letter code, followed by a dollar amount. Twenty-six codes range from A-Z and AA to EE.

Box 13: This box contains three checkboxes. If you are a statutory employee – an employee whose earnings do not fall under federal income tax withholding but fall under Social Security and Medicare taxes – the employer will thick the first box.

If you participated in the employer’s retirement plan, your employer would tick the second box.

Your employer would tick the third-party sick pay box if you received sick pay under your employer’s third-party insurance policy.

Box 14: Additional tax information can be reported in this box, such as union dues, health insurance, and non-taxable income.

Box 15: Shows your employer’s state and state tax identification number.

Box 16: if you fall subject to state income taxes, the total amount of taxable wages for state purposes can be written here.

Box 17: If wages were reported in box 16, then this box will show the total amount of state taxes withheld during the previous year,

Box 18: If you are subject to any other tax such as local, city, or other state income tax, those can be reported here.

Box 19: The amount of withheld local, city or other state income taxes will be reported here.

Box 20: Reports the name of the local, city, or state income tax reported in box 19.

For your comfort, here is a short video showing you how to fill the W2 form:

What Should You Do If You Get Two W2 Forms from The Same Employer?

If the Form W2s have different Employer Identification Number in box B, then enter each form separately.

You may have gotten two Form W2 because either your company changed payroll provides or changed ownership.

If the Form w2s are identical with the EIN matching, use only one of the W2 and either keep the other or destroy it.

If the federal income information In boxes 1-14 is similar or blank on one W2 and the state information in boxes 1-14 is different,

In boxes 1-14, if the federal income information is similar and the state information in boxes 15-17 or local information in boxes 18-20 is different, you’ll enter both kinds of info on the same W2 screen.

You should document all the information from a complete W2, then enter different state and local information from the other W2.

However, if only box 12 is different, enter all the information from the complete W2 form, and then enter box 12 information from the other W2 on the same screen.

Can You File Two W2 Forms Separately?

No. Your tax returns are registered to your social security number. When you file a tax return, you enter your social security number into the filing.

If you try to file a second tax return, the IRS will reject it and tell you that you’ve already filed a tax return with your Social Security number.

Besides, the amount of tax you owe to the IRS is based on your total income for the year. Hence, if your total income was reported in two W2 Forms instead of one, the tax will still be the same. So, you can’t file two W2 Forms separately.

What Happens If I Don’t File A Form W2?

If you were due for a refund from IRS, and you don’t file a W2, IRS may send you a message stating that they’ll hold your money until you send them the missing W2 form, or they’ll pay you a refund.

But, if you owe the IRS taxes, you will need to pay the difference. If you don’t file your Form W2, then you will face a penalty because you underpaid the IRS in taxes.

Conclusion

W2 forms show us how taxes affect the income of an employee.

These wage and tax statements are an integral part of tax returns because they show the amount an employee earned in a taxable year and the amount of tax withheld from their pay.

More Related Posts: