A credit shelter trust is a trust created by a married couple after the death of one spouse. It is designed to allow affluent couples to avoid or reduce estate taxes when passing assets to the couple’s next of kin. They are often irrevocable and are structured upon the death of the trust’s creator.

Credit shelter trusts are exemption trusts, bypass trusts, B trusts, or family trusts. A credit shelter trust is used to avoid probate and ensure that the wishes of the dead spouse are carried out. You can also use your credit shelter trust to shield properties from creditors.

A credit shelter can take many forms to serve a specific purpose. Even though they are used mainly by couples with large estates, couples with considerable financial assets can benefit from the credit shelter trusts. If you wish to create or update your estate plan, consider getting a financial advisor to help you plan accordingly.

Since selected trustees manage these trusts, surviving spouse never takes control of the trust’s assets. This means that transfers do not make any addition to the taxable assets of the surviving spouse.

Last wills and agreements indicate that a credit shelter trust is created and financed once the first spouse passes on. It can still be an advantage to the surviving spouse as it gives them the right to an income. Surviving spouses also can withdraw trust principal for their spouse’s support, maintenance health, or education.

Key Takeaways

– The primary usage of credit shelter trust is to minimize or completely reduce federal estate taxes for assets.

– Like any other trust, a credit shelter trust requires a contract between a trustee and a trustor.

– Credit shelter trusts protects your assets

Quick Navigation

- What is a Credit Shelter Trust – Estate Tax

- How Do Credit Shelter Trusts Work?

- What Limits a Credit Shelter Trust?

- Pros and Cons of Credit Shelter Trusts

- Pros of Credit Shelter Trusts

- Cons of Credit Shelter Trusts

- What Happens When a Credit Shelter Trust is Depleted?

- How to Set up a Credit Shelter Trust

- Bottom Line

What is a Credit Shelter Trust – Estate Tax

The primary significance of a credit shelter trust is to minimize or reduce federal estate taxes for assets transferred to beneficiaries. Credit shelter trusts were created in 1916, and they are also known as death or wealth transfer taxes.

Estate taxes can be a substantial lump-sum amount of money. The highest rate is often levied on assets over $1 million is 40%. Credit shelter trusts are not only for estates. If you have enough assets, they can be real money savers.

Estate tax laws often change at the state and federal levels. Remember to stay updated on legislation for effective planning.

How Do Credit Shelter Trusts Work?

Just like any other trust, a credit shelter trust requires a contract between a trustee and a trustor. A trustee is an individual paid to oversee the trust and ensure all terms of the trust are followed. On the other hand, a trustor is a person that provides the assets and starts the trust fund.

The contract lays out on the property included in the trust. Properties can be in the form of cash, collectibles, stocks, and bonds. Trusts also have trust documents that tell you how assets should be distributed to beneficiaries. For example, if you set up a trust, you can specify that the property won’t be given to your heir until they reach a certain age.

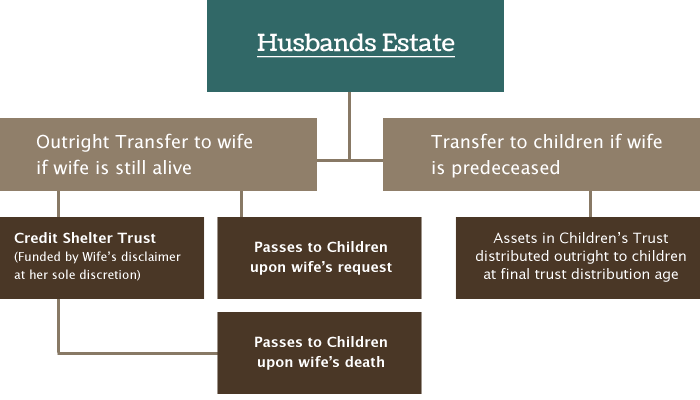

Since credit shelter trusts are created upon a spouse’s death, any property put in a trust is separated from the surviving spouse’s estate. When you are still alive, you can receive income from the property held in the trust. This allows you to go to beneficiaries without incurring taxes.

Upon the second spouse’s death, remaining assets in the credit shelter trust can be transferred to the beneficiaries tax-free. As long as the value of the remaining spouse’s does not exceed the estate tax exemption, it can be transferred to heirs without being taxed.

For example, you and your spouse have one child. Upon your partner’s death, he can bequeath his estate of about $7 million to you free of tax. In addition to yours, it would increase your estate to $ 14million, which exceeds the federal limit of $11.7 million, thereby imposing a huge estate tax burden on your child upon your death.

Therefore, your spouse decides to have their lawyer form a credit shelter trust for them. Upon their death, their $7 million would be established as a trustee under their lawyer’s control. You would be able to access income from the trust and use the funds for your expenses until your death. If your net worth is $7 million upon your death, your child would be spared the tax rate he should pay on an estate over $11.7 million.

What Limits a Credit Shelter Trust?

Credit shelter trusts are significant when each spouse has enough property value that reaches the estate tax exemption amount. This means that you cannot use a credit shelter trust when the estates are less than the exemption’s amount.

Pros and Cons of Credit Shelter Trusts

Credit shelter trusts’ pros and cons are obvious, but they also have a downside. We have highlighted the pros and cons of credit Shelter Trusts below;

Pros of Credit Shelter Trusts

Credit shelter trusts have lots of advantages. They include:

- It Offers Assets Protection

When you put your assets under credit shelter trusts, assets are protected. Various factors determine the distribution of the trusts, and they include:

- Provisions of the trust’s distribution

- The person named as the trustee of the trust

- Protection from creditors

- Protection from a future divorce in case the surviving spouse remarries

- Ensures Immunity

If the proper documentation is not filled upon the first spouse’s death, the first spouse may lose immunity. If the first spouse forces the financing of the trust account, they can make sure that their immunity is used.

- It Offers Control

Using the credit transfer trusts can ensure proper control in case of the first partner’s demise. They can control how assets will eventually be distributed when the surviving spouse dies.

This is especially significant in cases where there has been a previous marriage, of the surviving spouse decides to remarry. For example, your partner’s death can ensure heirs from the first marriage receive their shares of properties in case you pass on. Your spouse can also monitor your capacity to spend the funds when the trust is set up.

Most families tend to be concerned about giving a lot of money to young adults. If you set up a credit shelter trust, you can control the amounts and timing of property distribution to the children if your surviving partner also passes away. It also allows you to control how funds can be shared with other beneficiaries.

- Protecting the Trust’s Creator Intention

In cases of integrated families, spouses may need reassurance that the shares of their estates are passed to their preferred heirs from prior marriages. Credit shelter trusts ensure that their intentions are carried out correctly.

- Flexibility in Sharing Provisions

Your credit shelter trust can offer your surviving spouse a limited power of appointment for the surviving spouse. Your surviving spouse may share the properties among a group of heirs.

For example, a child that did not need a special needs trust during the drafting of the trust can get a special needs trust after the first spouse’s demise upon preference. The surviving spouse can appoint assets to a new special needs trust that caters to the child.

- Property Tax Benefits

Property distribution to an heir to the credit shelter trust is considered a distribution from the demised spouse rather than the surviving one. This transfer can take advantage of the demised spouse’s non-resident exclusion of parent-child assets tax. Spouses with valuable vacation or rental assets can benefit from an additional $1 million in reassessment exclusion.

- Surviving Spouses Get Rights to Assets

As long as surviving spouses live, they have certain rights to the assets in the trust fund. If allowed, they get their medical, educational, and living expenses covered by the trust’s principal and income.

Cons of Credit Shelter Trusts

Here are the disadvantages of credit Shelter trusts:

- They are Costly

Setting up a credit shelter trust can be expensive. It typically requires hefty fees to pay attorneys and accountants. If you wish to set up a credit shelter trust, you will significantly suffer the cost of maintaining, creating, and funding the trust.

Your trustee must obtain a different tax identification number, separate books, and records. They also have to prepare and file tax returns annually. This complicates the surviving spouse’s income tax returns which track the funding received from the credit Shelter trusts.

Since credit Shelter trusts are irrevocable, the trustee owes a duty of loyalty. They also owe a duty of impartibility between the remainder income and other beneficiaries.

- Loss of Second Income Tax

Community property estates get adjusted upon the death of the first spouse. Once your partner dies, their capital basis gets adjusted to a stepped-up basis. There are certain exceptions to this adjustment, including life insurance, cash, and income.

This adjustment affects any gain or loss if a property is sold. It also resets a depreciation value of any depreciating property, resulting in higher deductions for the living spouse. However, if you have a credit shelter trust upon your death, your property won’t undergo a second capital adjustment.

Stepped-up basis adjustment can cause a significant income tax liability for the beneficiaries of the credit shelter trust. This can outweigh the benefit of the tax avoidance credit shelter trusts are set up for. If assets are liquidated upon the second death, this outweighs the purpose of the bypass trust.

- Surviving Spouses have Limited Control of the Funds

Credit shelter trusts effectively deprive you, the surviving spouse, of control of the deceased spouse’s assets. This is because upon setting up a credit shelter trust, your spouse’s assets are controlled by the trustee.

- It is Cumbersome

Income tax returns have to be filed for the trust to get the benefits of the trust account. If the assets that finance the trust are complex, the paperwork can be expensive and tiresome.

- It is Irrevocable

This means that a credit shelter trust cannot be changed. The surviving spouse’s needs have to be carefully put into consideration when the trust is being set up.

What Happens When a Credit Shelter Trust is Depleted?

In some instances, the value of the first death’s gross trust may be depleted. Examples of deductions include:

- Debt deductions

- Expenses of administering the estate

- Funeral expenses

- It may not be large enough to use the estate exemption in full

In cases where the credit shelter trust is depleted, the unclaimed exemption can be set aside for the surviving spouse. The first descent’s attorneys have to make a portability election.

How to Set up a Credit Shelter Trust

Setting up a credit shelter trust is a rather complicated estate planning strategy. You can seek the advice of an estate planning lawyer to determine if it will be beneficial for you. The attorney must draft the trust and transfer assets into the trust.

Consider hiring a professional or corporate trustee if you have a large estate. Planning attorneys can recommend the right qualified trustee for your plan. The trustee has various responsibilities, including;

- Managing trust assets

- Investing assets to generate income for beneficiaries

- Preserve the trust assets for heirs of the assets.

You also have to choose the beneficiaries of the bypass trust. In most cases, surviving spouses are often the beneficiaries getting all income from the trust. They can also access trust principles. Individuals that will ultimately inherit assets in the trust when the beneficiary dies can be anyone you choose.

Bottom Line

A credit shelter trust can be an effective tax management tool for estates large enough to be exempted from the federal estate tax. They can be super helpful by making sure the surviving spouse follows the deceased spouse’s wish for the distribution of property.

Credit shelter trusts can protect a couple’s assets from creditors upon the demise of a spouse. They can also keep assets from tedious and time-consuming probate processes. These trusts are a tool that can be used for property management and estate planning.

Each spouse has to review their own estate plan to weigh its advantages and disadvantages. Some clients can have situations whose disadvantages outweigh advantages and vice versa. Working with a qualified and experienced financial advisor helps you determine the need for a credit shelter trust.