Is a 653 credit score good or not? Do you have a 653 credit score and wondering whether it is good or bad? A 653 credit score is considered to be a “fair” credit.

Many people, however, are confused by what they should do with this. If you are one of them, let us break down what a 653 credit score means for you.

The credit score is very important in determining your financial scenario. A good credit score brings you better loan options with reasonable terms and low-interest rates.

In contrast, a lower credit score will lead to the opposite outcome. Now, say you have a 653 credit score on your credit report. Let’s see what it means.

Quick Navigation

Is a 653 Credit Score Good? – What is a Credit Score?

Credit scores are financial numbers helping lenders to decide whether or not to disburse loans to you. In short, you can say that your credit score determines your eligibility for a loan. It is calculated based on your financial transactions and then presented into what’s called a credit report.

There are two major credit score models- FICO & VantageScore, which most credit bureaus follow. Both these models follow the standard credit score range of 300-850. Here, the highest possible achievable credit score is 850, whereas the lowest is 300. Your score can be anywhere between these.

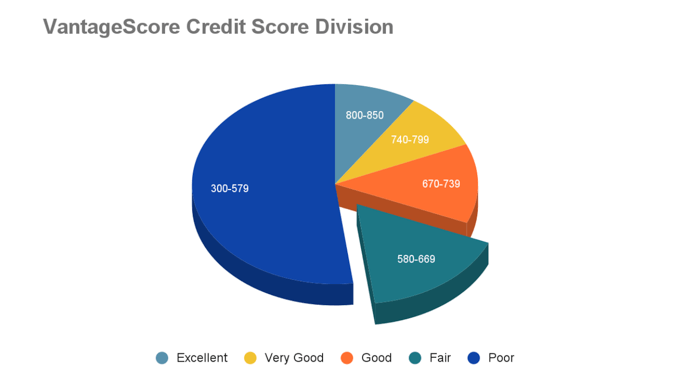

Standard credit scores are decided on the basis of certain credit score ranges. See these tables below to understand how credit score ranks work.

VantageScore Ranges

| Excellent | 800-850 |

| Very Good | 740-799 |

| Good | 670-739 |

| Fair | 580-669 |

| Poor | 300-579 |

If you follow the VantageScore ranges, a bad credit score is any number between 300-579. If anyone’s credit report reflects these numbers, they have a low or “poor” credit score.

A “fair” credit score is when you have a score ranging between 580-669. If you have a 653 credit score, it is within the “fair” range. You can still bag some good loan offers, interest rates, credit cards at this credit range.

Yet, sometimes it can be very hard at this range to get some profitable loan offerings. You can still revive your position by following steps on how to improve your credit score.

Then comes the “Good” range, which is between 670-739. Now, if you go higher than 699, your credit score will be considered Very Good.

The “Very Good” range lies between 740-799. Anyone obtaining this score will have many benefits in terms of loans, lower interest rates, offers, cashback, etc. Getting the “very good” range will bring you a lot of opportunities right at your doorstep.

Now, anything higher than 799 and ranging between 800-850 credit score is considered “excellent.” People falling between this margin are the ideal kind for borrowers, mortgagers.

You won’t be facing any financial obstacles if you can maintain a credit score in this range.

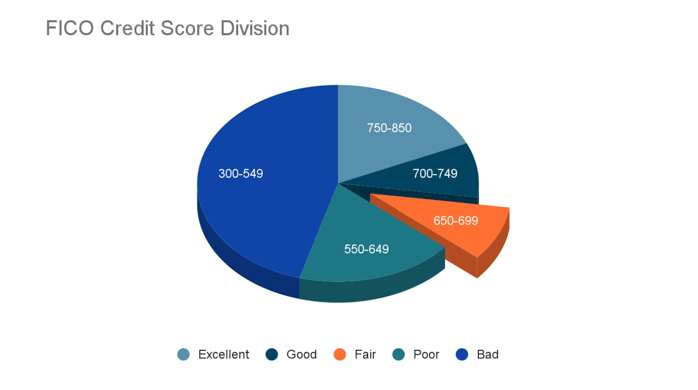

FICO Ranges

| Excellent | 750-850 |

| Good | 700-749 |

| Fair | 650-699 |

| Poor | 550-649 |

| Bad | 300-549 |

FICO also has the same 300-850 range for the credit score model. Yet, their ranks differ from that of VantageScore. For FICO, a “Bad” credit score ranges between 300-549.

A “Poor” credit score is when it is between 550-649. Above that, from 650-699, it will be considered “Fair.” So, if your credit score is 653, it is still within the “Fair” range.

Above the fair range, there is a “Good” credit score ranging between 700-749, which has similar benefits as with VantageScore ranges. And when you have a credit score above 749 up to 850, it is considered “Excellent.”

Although the credit score rankings are different, the benefits are almost the same. Thankfully, a 653 credit score falls in the “fair” range in both score models.

Is it bad? Or is it good? We need a detailed discussion before commenting on how good or bad the 653 credit score is.

Is a 653 Credit Score Good?

So far, you have understood the credit score models and how they classify different credit scores based on their ranges. And, as per the classification on both the scoring models, a 653 credit score is considered “fair.” So, what does it mean? Where does it take your financial fate?

A “Fair” credit score is a bit tricky. You see, a low or poor credit score tells you that your chances of getting a good offer are pretty low. On the contrary, “good,” “very good,” or “excellent” credit scores are sure to bring you lavish deals. The problem is with anything that is stuck between- the fair range.

In this range, you do get multiple offers. Yet, they might come with high interest rates. Some credit card companies may or may not offer you credit cards without annual charges. Again, you will get personal loans, car loans, mortgages, etc., with no certainty of a direct breakthrough.

Thus, it somehow lowers your chances without stopping you entirely. Yet, there is room for improvement. You can work hard to improve your credit score. Later in this article, we have mentioned how to improve your credit score.

But for now, let’s focus on the things that you can achieve with a 653 credit score. We will take a walkthrough of the benefits and intricacies of such a credit score.

Here we have enlisted certain areas to see whether or not this credit score will bring you any good results. Let’s move forward.

What Options Do You Get with a 653 Credit Score?

The options aren’t very lucrative at this credit score. Yet, they’re not dim either. You have room for improvement. Here we are going to see how much you can bag at this credit score. First, let’s start with your luck at car loans and see what you will get here.

Car Loans

A FICO score of 653 cannot bag you any lucrative offer in car loans, yet you won’t be denied one either. The Average APR at this range is 6.61% for new cars, whereas 10.49% for used ones (Source: Experian Information Solutions, Q2 2021). Let’s run a calculation to understand the difference between this and something in the “Good” FICO score range.

Let’s say X’s credit score is 653, whereas Y has a 710 credit score. They both apply for a car loan worth $30,000. The Average APR at 653 for a new car is 6.61%, whereas, at 710, it is 3.48%.

The Loan tenure is 36 months.

See the table to understand how much you save with a higher credit score:

| Loan Tenure | Total Amount | Interest Rate | Monthly Payment | Total Interest Paid | Total Payment |

| 36 | $30,000 | 6.61% | $920.97 | $3,154.92 | $33,154.92 |

| 36 | $30,000 | 3.48% | $878.80 | $1,636.80 | $31,636.80 |

So, Y saves a total interest of $1,518.12 with a higher credit score. As you see, getting a car loan with a 653 credit score is not a big deal. Yet, with a better credit score, you can lower the interest rates to a significant number.

(P.S. The interest rates calculated here are not specific. Interest rates depend on individual credit scores. We have used an average interest rate to provide a basic understanding of the difference it makes.)

Personal Loans

You will get personal loans with a 653 credit score, yet it won’t be anything superb. The average interest rate for this range is between 15% to 17%. In most scenarios, it is between 16% to 17%. Hence, you won’t profit much from this average credit score of yours.

Yet, as said earlier, there is always room for improvement. With a little hard work, you can see the interest rates dropping by 2%, at least in the future. The interest rates change a lot with the change in credit scores. If you can improve your credit score, the interest on personal loans will improve as well.

Credit Cards

With a 653 credit score, you can’t expect the biggest banks in your country to offer their best cards to you. However, since your credit score is within a fair range, it won’t be hard to find some average or decent options either. A 653 credit score will open doors to some secured and unsecured credit card options.

So, what is a secured credit card? A secured credit card is the one that requires you to put down a security deposit before availing. On the contrary, an Unsecured credit card doesn’t require you to deposit any security amount for approval.

However, there might be some catch with Unsecured credit cards. For instance, an unsecured credit card might come with a higher average APR for a credit score in this range. Again, the credit limit might be on the lower side.

Apart from this, you can also have trouble with getting your loans approved or applying for a higher limit. But, if you maintain your repayments and never fail, your credit scores will improve. Several months of on-payment can do magic into your credit report.

So, if you are wondering whether or not a 653 credit score will help you get credit cards- they will. Yet, the options might not be desirable, with low credit limits and high-interest rates.

Mortgage

With a FICO score of 653, you will most likely get a home loan easily. The conventional credit score for a credit loan is 620. Since you are in the 650-699 range, you won’t have much trouble getting a mortgage. Yet, the interests will be something around 2% to 3% in this range.

A slight rise in your credit score may lower your interest rate by 1%. Even a 1% increase in your credit score can help you save more than $100 annually.

Now that you know about your 653 credit score, let’s just move forward and see how your credit scores are calculated.

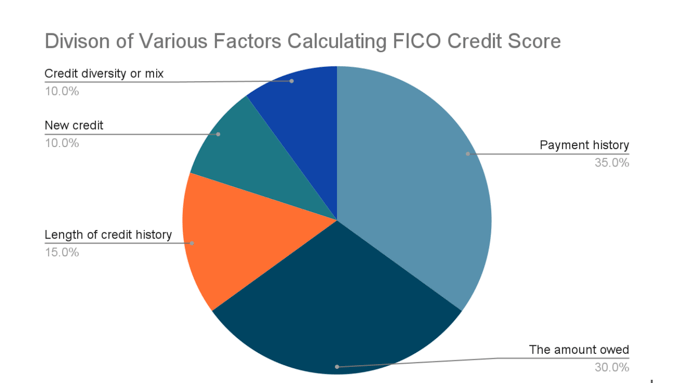

How Is Your Credit Score Calculated?

FICO does not reveal its credit score calculation formula. But, it is well-known that there are five major key points used to calculate your credit score. These are:

- Payment history (Plays 35% role)

- The amount owed (Plays 30% role)

- Length of credit history (Plays 15% role)

- New credit (Plays 10% role)

- Credit mix (Plays 10% role)

Payment history has the largest role to play in this chart. It incorporates details of your financial transactions, including bankruptcies, delinquencies, failures, etc. As a result, 35% of the total score comes from your payment history.

The payment owed is the credit you have left in your account as compared to your debt amount. If the credit limit is higher than the debt amount, you will have better chances. Lenders like to believe that people who have maxed out their cards are more likely to face difficulties in re-payment. 30% of your credit score comes from here.

Next, the length of credit history recognizes the average age of your accounts and when you used them last. The next two smallest factors are- new credit account and the diversity of your credit portfolio. Each contributes 10% to your total credit score.

How to Improve Your Credit Score

653 is a fair credit score that hangs you over the edge of financial benefits that you might have acquired with a better credit score. Worry not! The fair range can be easily pushed to a good degree by following specific methods. So, if you ask if it’s possible to improve your credit score, the answer is yes.

How to improve your credit score? Follow these practices in your regular life, which will help you better the score over time.

Pay Your Debts on Time

Missing payments can affect your financial records, i.e., credit report. Likewise, making all your payments regularly will help you better your credit score over time. If you have a 653 credit score, maintaining your payment schedule will soon reflect on your credit report.

Low Credit Balances Help

Your debt and available credit have a way more impact on your credit report. The lower the credit balance, the better. Your credit card balance shouldn’t be higher than 30% of your credit limit. Also, maxing out might have a negative impact. Make sure to maintain the overall picture.

Be Smart While Taking a Loan

Be smart while taking a loan. You can talk to your loan provider before applying for any and see if it improves your overall credit score.

Mention Your Old Debt Records

Many people make a mistake that might seriously affect your credit score. As soon as a debt is fully paid, they call the bureau to remove it from their report. Keeping the old debt records shows how trustworthy you are. So, keep those instead of removing them.

Conclusion

So, is a 653 credit score Good? No, it is not good. Instead, it’s in the “fair” range. Even though you will bag both secured and unsecured credit cards, car loans, mortgages, and personal loans, the interests will be high. And, you might feel the terms to be stringent as well.

Yet, there is always room for improvement. If you want to improve your credit score, simply follow the steps that we mentioned in how to improve your credit score. A credit score in the “Good” range will bring you some good fortune at the least. That said, we hope we could clarify your question and see you again soon.