Can you use a check with an old address? The question that gets asked pretty much by anyone who never used a check before, or even people who do, but just never thought about it until they noticed they moved 3 times already and have the same old address on their check book.

Well, this article is for you. Whether you want to know if using a check with an old address is ok, or just what it means, or even just learn about the different elements of a check, keep reading below.

We live in a brave new world and a tumultuous new economy. Everything we once knew to be true is shifting the way leaves turn color as the weather changes.

9-to-5 desk jobs are no longer sought with favour, and freelancing is one of the popular ways to earn money.

Stronger skill sets and personalities that test well in the psychometric analysis have taken precedence over college degrees.

It can be easily said that we are in the midst of a technological revolution. Job security is a luxury, and the workforce is shifting gear towards entrepreneurial ventures instead of subjugating to expansive conglomerates.

All these changes are bound to affect a person’s median income or even the aggregate household earning.

Job descriptions have also become vaguer, and an employee’s responsibilities and utility may vary regularly.

A person’s job may entail them to move to a different location within the same city, move to a different city, or even shift to a new country entirely.

Personal addresses are also subject to change when the individual is looking for better educational and lifestyle opportunities elsewhere.

The world is your oyster, and your visa a travel document. In such a situation, your banking information may also need to be changed.

This can be a hassle as banks now exhibit more scrutiny when cashing checks or debiting and crediting cash to bank accounts to avoid fraudulent activity.

However, you may have checks that were in transit as you were changing your mode of residence. So, the address the check may have associated with you may no longer be the address you currently have.

Quick Navigation

- This begs the question: Can you use A check with an old address?

- So Can You Use Checks with an Old Address?

- Cashing Checks with an Old Address

- Issuing Payments on Checks with Your Old Address

- Being Responsible with Banking Information

- Where Can I Get New Checks From?

- Can I Use Something Other Than Checks?

- Can the Old Checks I Have Issued or Received Expire?

- How Can I Dispose of Old Checks That Have Expired?

This begs the question: Can you use A check with an old address?

The Different Components of a Check

- Name

- Address

- Date

- Payable to section

- Signature

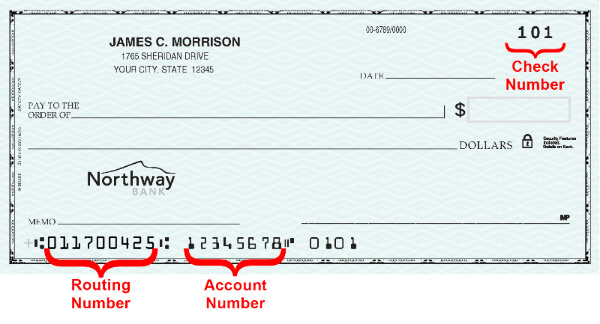

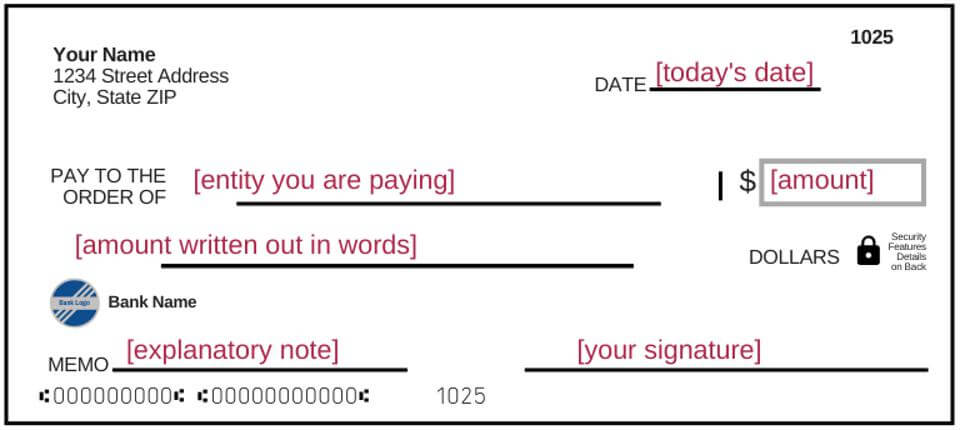

Besides your name and address, a single personal banking check contains a lot more information that is more relevant to the bank when processing a check.

Your check contains the date you issue the check, the person/organization you are paying the cash to, and a blank space to place your signature on.

It also contains other banking information such as your bank account number and your bank routing number.

Another wonderful innovation to streamline using checks is the inclusion of MICR lines on the checks.

The Magnetic Ink Character Recognition line is used to authenticate the check and the transaction and is used by the sender’s bank to scan the check.

So Can You Use Checks with an Old Address?

Absolutely you can. While most checks contain the recipient’s address, the banking name and the routing number make the biggest difference.

Cashing Checks with an Old Address

The name of the beneficiary, the bank account number, and the account routing number are three of the most vital pieces of information you would for money to be deposited in your bank account with accuracy.

As long as this data is accurate and up to date, you should face no challenges getting the check to cash or credit into your bank account.

Issuing Payments on Checks with Your Old Address

Simply put, this is also no biggie. Many people never order new checks with their new addresses before running out of their old stack of checks.

They simply put a cross with a pen where their address is printed, and write in the new one.

Of course, a signature is needed to put next to the handwritten change to signify the sender did it.

In fact, most people also change their surname after marriage or divorce, and the banking information is still airtight.

The bank of your choice should have no qualms in approving the transaction of money.

Your signature on the check should match with the signature the bank may have on file.

If the signature, banking information, or routing number have any mismatches, it can cause a problem to occur.

The authenticity of these three dictates the process of issuance and deposition of checks from one bank account to the next.

When these are correct, other information such as your name and address become less important.

Being Responsible with Banking Information

However, the ease of practice is not a ticket to be irresponsible. You should always update your address in the case of a change.

Doing this is just another way of being a responsible citizen and easy to contact in any problem.

As a bottom line, you must remember: yes, you can use checks with an old address and even your old, as long as the account number and routing number are absolutely accurate and belong to you.

If everything checks out, the money is finally deposited into the recipient’s bank account.

Pro-tip: You may write your phone number on the check just so that the bank can contact you if they need immediate confirmation of information.

Where Can I Get New Checks From?

While the first bulk of checks is given to you by your bank for free as a gesture of goodwill, ordering checks repeatedly can be costly.

The first thing you could do is inform your financial institution that you need a new checkbook and choose a checkbook with the appropriate amount of leaves.

Remember not to order checks when you finish your existing batch, as the new order of checks are sent by mail and may take quite some time to reach you.

If the bulk of your monetary transactions involve using checks, you should find new, less expensive options.

The best way to lower this expense is to buy blank checks online from the many trustworthy sites offering the item.

Online companies like Checks In The Mail, Carousel Checks, and Costco Checks are some of the safest and most reputable options to choose and order checkbooks from.

They are also less expensive than ordering from the bank and have more options for customization.

Seasonal offers and discount coupons have also driven up sales for these unconventional, but overall, incredible options.

Can I Use Something Other Than Checks?

Checks are a better and safer mode of transaction than cash or credit cards. They are also handy when transferring larger amounts of money.

Sometimes, however, people do not have a permanent address to update their banking information with.

They are either in between shifting locations or squatting at someone else’s residence, or just traveling a lot.

These people do not know where they will be tomorrow, so it becomes difficult for them to notify their banks or their employers.

Changing the old address frequently and waiting for new checks with the updated address to arrive can be a tad bit annoying, especially if the new address will also change within a year.

Ordering new checks regularly can also inflate the costs and become large, unnecessary expenditures.

Check books can also get lost in the mail and can be intercepted and used in unapproved banking activities. It’s quite the gamble to go down this “checkered” route.

People can always opt-out of using checks to receive money or pay someone back in such a situation.

There are four basic options that you can try if you are tired of checks.

1. Certified Funds

This is an option for individuals who do not write checks very often and have no utility for a whole checkbook.

Certified funds can be used by people making big down payments when purchasing a house or a car or paying the rent for the first time, which requires money upfront.

2. Money Orders

Money Orders are a popular alternative to using checks because they are a very safe mode of payment.

It is safer than cash as it cannot get stolen and used for transactions without confirmation.

It is an excellent tool to use when you want to transfer large amounts of money without giving away too much of your personal information.

A second layer of the safety net that comes with money order requires that the person issuing the money order needs first to deposit the cash and then issue the payment slip.

This ensures guaranteed payments, unlike checks, which can bounce due to a lack of funds in the sender’s bank account.

3. Cashier’s Checks

One of the most significant advantages of using cashier’s checks is the security that comes with it.

The payment can only be extracted from the payee’s check, the person to whom the check was issued.

Unlike checks, there is little chance of fraudulent activity. Cashier’s checks are also quicker than personal checks to clear out and deposit into the recipient’s bank account.

4. Online Banking Transactions

Cash is limited and unsafe to carry. It is no longer the preferred mode of transaction.

In today’s world, more and more people are switching to online banking, and they have a strong reason to do so.

Automation is one of the biggest advantages of opting for online banking. Forget one window operations; banking online provides you the ease of one-click operations.

The ability to perform transactions around a 24-hour clock also enables employers to pay employees residing in different time zones without any added trouble.

Can the Old Checks I Have Issued or Received Expire?

For ease of financial transactions and to avoid inconvenience, personal banking checks usually expire six months from the date of issuance. This is also true for checks issued by the government.

One thing to be mindful of when you receive a check is not being lazy about cashing it in.

Try to deposit them in your bank account within a week of receiving the check.

Because you technically do not have the cash in your bank account till the check is deposited, it would be irresponsible not to cash the check as soon as you receive it.

Plus, personal checks usually take around a week to materialize into your account after they are deposited.

In matters of cashing in checks and otherwise, time is of the essence.

Remember: cash it in, don’t phone it in.

However, the fine print is that checks that have only be written on and signed off are bound to expire after the six-month mark.

Empty checks can always be used, and there is no real expiration date for them.

If the checks are blank and have the banking number and routing number that corresponds correctly to your banking information, you can use them to pay bills or employees for as long as you want them to.

To reiterate, your old address or name should not cause a problem.

The only time a check is subject to expire is when it has been filled out with an issuance date.

How Can I Dispose of Old Checks That Have Expired?

Human beings make errors and mistakes. That’s part of the contract. Sometimes, these mistakes are made on a check we were supposed to write.

Whether it is the incorrect date, or too many zeroes (hello, Jeff Bezos!), or the incorrect signature, nerves can make us to a lot of tiny, annoying errors.

That’s okay. The critical thing to understand is that these checks need to be properly disposed of if there are mistakes, and the check is not going to be used any longer.

This also holds for expired checks. Consider a situation where you wrote a bunch of checks that were supposed to be sent out, but for some reason or another were not, and have hit their expiration dates.

Disposing of these checks becomes an immediate responsibility as they may be used by someone else to extract money from your account through counterfeit means.

Burning them and scribbling them with ink (art project idea for the kids, maybe?) are good, viable options if you want to destroy checks that are no longer in use.

Another excellent method of disposing of checks is to cut them with a pair of scissors or run them through a shedder.

Cut into the thinnest, tiniest shreds imaginable and throw them into the sea. We’re kidding about the part about the sea; of course, littering is wrong by all means.

Throw the shreds into different wastebaskets or dispose of them in clumps on different days, so the checks become irretrievable.

We know this can be quite taxing, but you love the money in your account, right? Then this is an event you should take seriously.

Overall, we hope this article was of help to you and your basic banking queries.

1 thought on “Can You Use A Check with An Old Address?”